Note: this is an unedited draft, written at 9AM in the morning

The Russian invasion into Ukraine has the potential to create a major disruption to the global supply chain, accross industries – from energy to agriculture and high tech. The obvious – and much talked about – is the energy sector with prices sent to the proverbial roof (and they are not low to begin with since we are talking about the energy crisis for a while now). High energy prices translate into a potential fertilizers crisis which would have a direct impact on the food production and supply chain. At the same time, the situation is not making things easier for dealing with inflation – which is already high as well, considering high energy prices makes all production expensive.

However, there is another sensible and critical sector that is not much mentioned which is likely to suffer yet another crisis: the semiconductors sector. At the beginning of the pandemic the world has had to deal with a semiconductors’ crisis – the demand was so high that production couldn’t accommodate it. That’s likely not going to repeat itself in the very same shape and form. Instead, this time, production prices will go up because the price of Neon, a key material used in chipmaking, is likely to grow high.

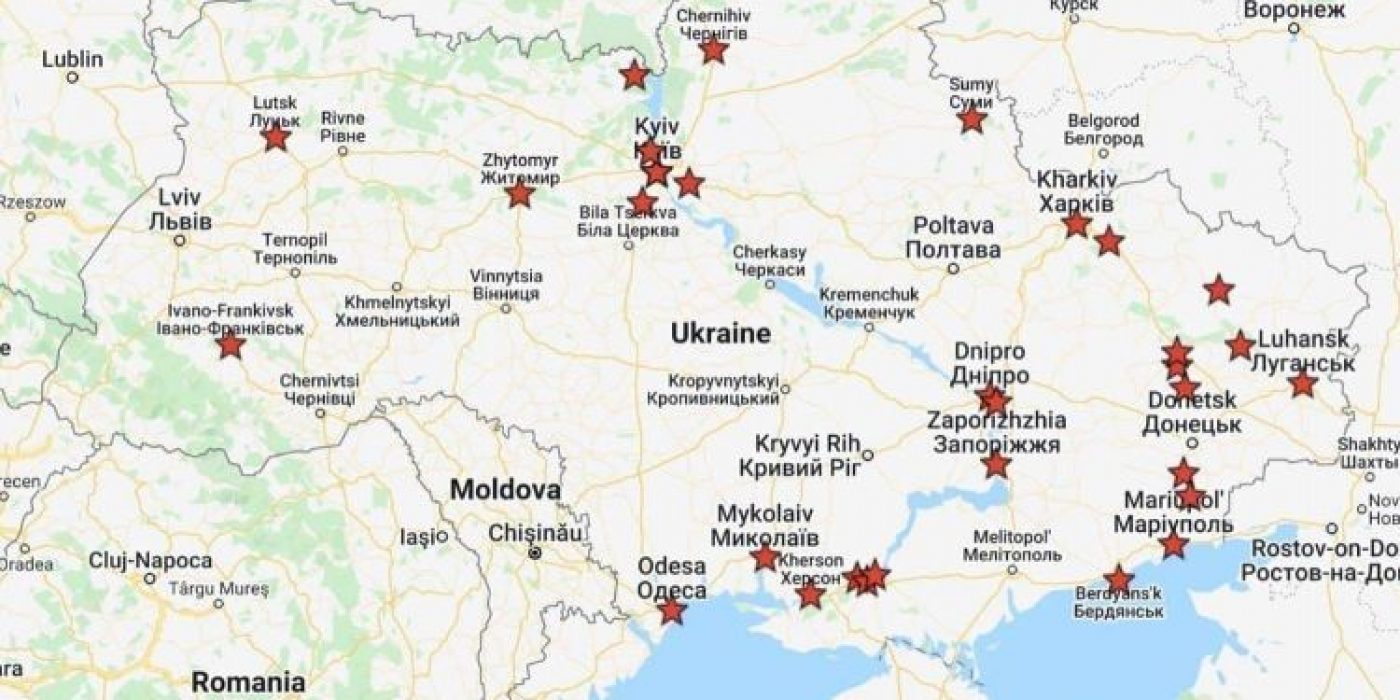

Ukraine supplies most of the world’s neon gas (according to industry reports nearly 90%) and key facilities are in Mariupol – the Ukrainian part of the Donbass region and Odessa, a key port at the Black Sea. With Russian forces advancing their way into the separatist regions, Russia is menacing a direct attack on the Southern corridor – which would have Russia control the northern Black Sea shores and therefore the neon production sites. This may mean that supplies of neon would be reduced in volume if not cut for a short period of time, making it more expensive and therefore triggering a new semiconductors’ crisis – a price crisis that will affect all producing sectors of phones, computers, industrial machinery, automobiles and… kitchen appliances, all things that have chips within.

The way sanctions will work

The U.S. White house have just announced the next steps taken and sanctions have been mentioned to be a first step. The “unprecedented” sanctions will be taken against energy producers (Germany already announced the halt of the Nord Stream 2), key mining and steel manufacturers and financial institutions.

Russia controls roughly 10 percent of global copper reserves and is a major producer of aluminium, nickel, platinum, and other precious metals. For the chipmaking industry, the world uses palladium – 35% of U.S. palladium is sourced from Russia, for example. The current crisis translates into an increase of price for all these commodities.

The Western imposed sanctions will likely include restrictions on banks sending and receiving messages through the SWIFT system (the Society for Worldwide Interbank Financial Telecommunications). This is meant to limit Russian access to funding – it would make access to external borrowing nearly impossible and therefore it would halt many business transactions.

Under the sanctions, American and European businesses would also be embargoed – especially when it comes to the industrial sectors (energy, mining, steelmaking sectors). The technological sector will also be targeted – and would incur a high negative impact. At the same time, it is likely that Russia would retaliate and introduce counter-sanctions, banning food and other imports from the West.

More concerning however, is the potential deployment of Russian daunting cyber capabilities in an asymmetrical response to Western imposed sanctions. Cyberattacks originating in Russia are not new for the European borderlands. However, considering that Russia will react to the economic sanctions, it is likely that the Russian cyber capability would deploy to attack the Western economic systems. An indiscriminate cyberattack would hit private business enterprises and public institutions alike, potentially sowing chaos across the Western system.

The key questions, the key ideas

Apart from the global supply chain being affected, building up our resilience capabilities to cope with such a scenario is key for resisting the Russian aggression. In practice, these are several issues for businesses to take into account in trying to mitigate against expected risks coming out of the current Russian attack on Ukraine:

- A first step is assessing visibility to the company value chain (production and supply chain alike). That means responding to the following questions: who makes critical parts? What is the business’ most vulnerabe dependency? What is the inventory status? What other alternative sources are there?

- Build inventories for vulnerable supplies – expect shortages of Russian and Ukrainian raw materials

- Secure supply for energy sources – anticipate continued increase in energy prices

- Ensure effectiveness for transportation – transportation costs will increase

- Develop and work on a business risk-assessment and scenario planning – this will allow you forecast upcoming problems and your business will be in a position to fight back against adverse conditions.